Comparing options often comes down to choosing the lowest cost option. This often ignores the inherent assumptions that may apply to each option. There could be significant ramifications if these assumptions do not eventuate, either due to increased costs and/or health & safety incidents. Essentially, these assumptions represent risks and should not be ignored.

Even if risks are considered, they are more often than not treated very simplistically. Typically the risk is either evaluated as more than likely, in which case the consequence is included as a fait accompli – leading to a conservative cost estimate, or less likely, whereby the risk is totally discounted, leading to an optimistic cost estimate.

When some of these risks relate to sustainability issues, approaches typically involve some form of qualitative evaluation because the risks are seen as intangible and unable to be quantified. At best, a semi-quantitative approach is adopted. Often these approaches have such nebulous results that the risks are eventually ignored when the final decision is made on the preferred option.

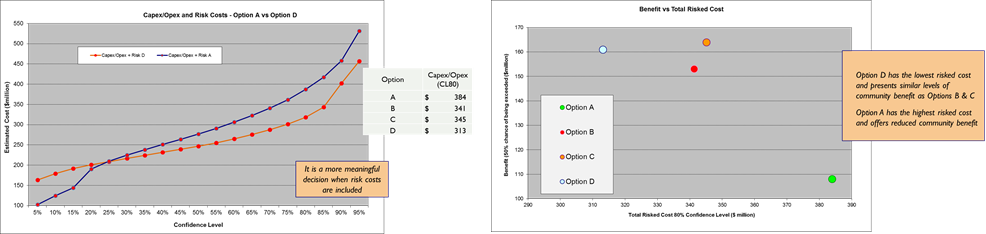

Our approach evaluates options by accounting for capital and operating costs, risk cost (including so-called “intangibles”) and benefits. It quantifies all of these parameters in financial terms which then enables all options to be fully compared based on a common denominator. The approach is inclusive and defensible to a range of stakeholders, both internal and external, if required.